Everyone knows what Medicare is, right? Not necessarily. Despite ongoing discussions about the program in politics, media, and the healthcare industry, there are persistent misconceptions in the general public, especially for those who are about to turn 65 and become eligible for Medicare.

Misconception 1: Medicare costs nothing and takes care of all medical needs for people aged 65 or older, and younger people with certain disabilities.

Reality: There are several levels of Medicare coverage and only one is premium-free. Part A, which covers portions of inpatient hospital insurance, skilled nursing, home health care, and hospice, is available to you at no premium if you have worked 10 years (or 40 equivalent quarters). It’s important to note that Part A does not cover things like long-term care or Part D prescription drugs. The purpose of Medicare is to protect you financially should something disastrous, like a heart attack or cancer, happen to you. Beyond that there are several, very affordable insurance plans you can purchase from private insurance carriers to cover any gaps in coverage.

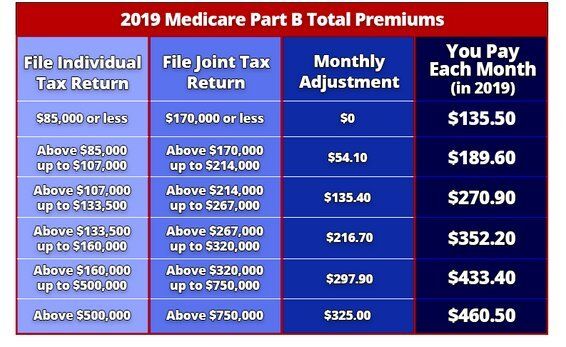

It is important to know you have choices for how you get your Medicare coverage. If you choose to have Original Medicare, Parts A & B, you may have some gaps in your coverage. A portion of the payroll taxes paid by workers and their employers cover most Medicare expenses. Although Part A may be premium-free, there are monthly premiums for Part B, usually deducted from Social Security checks, which cover up to 80% of your health care costs.

It’s important to know that Original Medicare does not recognize a yearly maximum out of pocket cost for health care services so all costs that are not covered by Medicare will require out of pocket payments for any and ALL services rendered. This is why it’s important to note that you can buy a Medicare Supplement policy (aka Medigap) from a private insurance company to help cover those costs that Original Medicare does not cover.

The Centers for Medicare and Medicaid Services is the agency in charge of the Medicare program. You can apply for Medicare Parts A & B at your local Social Security office, or you can simply apply online at https://secure.ssa.gov/iClaim/rib

You can also contact Medicare directly by calling 800-633-4227 and they can give you general information about the Medicare program.

Misconception 2: I can’t sign up for Medicare until I retire.

A lot of people associate the Social Security retirement age as the same age as Medicare eligibility. Regardless of the age you choose to participate in Social Security benefits, Medicare eligibility begins at age 65, or sooner if you have been on SS Disability for 24+ months, at which time you automatically qualify for Medicare no matter what your age. There is a seven-month window when you are turning 65, called your initial enrollment period (IEP), to sign up for Medicare. This includes three months before your 65th birthday, your birthday month, and three months after.

In most cases, if you don’t sign up for Medicare Part B when you’re first eligible, you’ll have to pay a late enrollment penalty. You'll have to pay this penalty for as long as you have Part B, and you may also have a gap in your health coverage.

However, you may have the chance to sign up for Medicare during a special enrollment period (SEP) if you are still working and you are on an employer health plan that includes creditable drug coverage (coverage equal to or better than Medicare drug coverage). Regardless of the age you retire from your employment, you will then have an eight-month SEP window to sign up for Part B as long as you or your spouse are working AND you're covered by a group health plan through the employer or union based on that work. Usually, you don't pay a late enrollment penalty if you sign up during an SEP.

Regardless of whether you join Original Medicare at age 65 or when you retire from employment, the question you need to ask yourself is what kind of Medicare supplement insurance you will need to cover the gaps that Original Medicare A&B do not cover.

We will look more into Medicare Supplemental coverage options, known as Medigap, in future posts.

If you have general questions about the programs, feel free to call me at 408-849-4460 or email me at julie@jbinsurance.biz.